Table of contents

- Introduce

- 1. Basic Factors: Supply and Demand

- 2. Effects of volatility in global markets

- 3. Influence of international policies and strategies of oil-producing countries

- 4. World Economic Factors and Consumption Trends

- 5. Environmental Factors and Renewable Energy

- 6. Effects of Epidemics, Natural Disasters and Wars

- Market structural factors

- Conclude

Introduce

Oil prices are not only an indicator in the energy market, but also an important indicator of the global economic situation. The relentless volatility of oil prices not only affects consumers through gasoline prices, but is also a source of inspiration and challenges for investors and market researchers. In this article, we will analyze the factors that affect oil prices in detail and logic.

1. Basic Factors: Supply and Demand

Oil supply: The law of oil supply depends not only on the production of countries such as Saudi Arabia, the United States, and Russia, but also on geological capabilities, drilling technology, and environmental factors. Countries usually maintain a maximum level of production to stabilize the price of oil in the market.

Oil demand: The demand for energy comes not only from industries and transportation, but also reflects global consumption trends. The rise of emerging economies such as China and India has also boosted demand for energy, driving up oil prices.

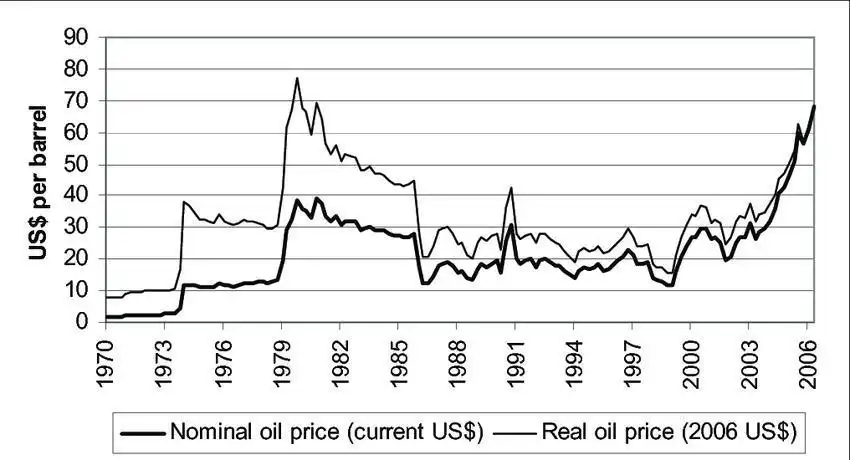

2. Effects of volatility in global markets

Factors such as political conflicts, stability in oil-producing countries, and the impact of natural disasters can all cause sudden fluctuations in oil prices. For example, conflicts in the Middle East often lead to an increase in oil prices due to fears of supply disruptions from the region.

3. Influence of international policies and strategies of oil-producing countries

Decisions by organizations such as OPEC+ and other oil-producing countries can have a significant impact on oil prices. These countries often discuss and make decisions about production levels to stabilize oil prices on the global market.

4. World Economic Factors and Consumption Trends

The health of the world economy is especially important for oil prices. As the world economy grows, demand for energy increases, leading to an increase in oil prices. Conversely, when there is a slowdown in the economy, demand decreases, lowering oil prices.

5. Environmental Factors and Renewable Energy

The transition to renewable energy sources and environmental protections are increasing, posing challenges to the oil industry. This shift could lead to a decrease in oil demand, affecting future oil prices.

6. Effects of Epidemics, Natural Disasters and Wars

Epidemic: The COVID-19 outbreak has created a major disparity in global oil supply and demand. A drop in demand due to production disruptions and travel limits has brought down oil prices. At the same time, epidemic prevention measures such as social distancing and travel restrictions have also reduced transportation and energy demand, affecting oil prices.

Natural Disasters: Natural disasters such as hurricanes, floods, and earthquakes can disrupt oil production, transportation, and processing. This disruption could lead to a decrease in supply and an increase in oil prices, especially if major oil-producing regions are affected.

War: Wars and armed conflicts in major oil-producing areas or shipping routes can cause supply safety concerns. This concern could lead to an increase in oil prices due to increased demand as a backup in case of supply disruptions.

Market structural factors

Competition in the Oil Industry: Competition between major oil and gas companies can also affect oil prices. If a company dominates the market and controls a large amount of supply, it can shape the price of oil to its liking.

Energy Technology Development: Renewable energy technologies and new oil extraction technologies can change market structures. The development of renewables can reduce oil demand, while new technology can increase production, affecting oil prices.

Conclude

Overall, oil prices are not merely a number across the board, but the result of complex interactions between global supply and demand, political, environmental and economic factors. To understand and forecast oil prices, one needs to keep a close eye on these factors and do thorough research. A deep understanding of these factors not only helps in effective investing, but also helps forecast fluctuations and opportunities in this challenging energy market.