FOMO, short for “Fear of missing out”, is a common psychology that affects many aspects of life, including our investment decisions. In this article, we will learn more about FOMO, how it affects our investment decisions, and how to control FOMO to make wiser investment decisions.

Table of contents

1. FOMO and Investing Psychology: How It Affects Your Decisions

FOMO is an emotion of anxiety and fear about missing out on positive experiences that other people are having. For example, you’re worried that your friends are throwing a great party without inviting you, or that people are making big profits from an investment in which you weren’t involved.

In an increasingly connected world, FOMO is increasingly common due to the rise of social media and financial news. We are constantly exposed to images and information about the amazing experiences other people are having. This makes it easy for us to feel missed out and worry that we are missing out on important opportunities.

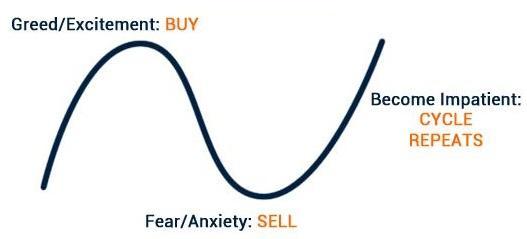

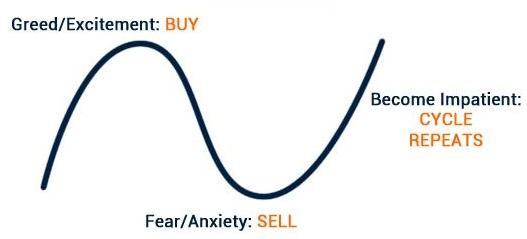

In the investment field, FOMO can cause investors to make hasty, thoughtless decisions. When they see a stock or crypto asset increase in price sharply, they are afraid of missing out on a big profit opportunity, so they rush to buy it without careful consideration. This mentality also makes them not dare to sell when prices are rising for fear of missing out on the next profit opportunity, even when it is the right time to take profits.

FOMO also makes people easily influenced by rumors or “investment advice” spread on social networks. They are afraid of missing out on opportunities, so they rush to invest in risky assets without researching and analyzing themselves. All of these actions are based on emotions rather than reason, easily leading to losses for investors.

To make wise investment decisions, we need to control FOMO by:

- Don’t get caught up in your emotions when you see prices increase/decrease sharply. Calmly analyze the causes and prospects before deciding.

- Build a long-term investment strategy based on your goals and risk appetite, don’t let FOMO change your plan.

- Only invest in assets you understand well after thorough research, not out of fear of missing out on new trends.

- Stay away from unofficial sources of information, do not believe in rumors or “free advice”. Always seek information from reputable sources.

If you control FOMO, you will make more informed investment decisions, helping your portfolio grow sustainably.

2. Conclude

In short, FOMO is a dangerous investment psychology if not well controlled. It causes investors to rely on emotions, make reckless and ineffective decisions. To invest successfully, we need to build a clear strategy, not get caught up in FOMO. Analyze carefully, invest in assets that suit your goals and risk appetite. Only then can we develop an effective and sustainable investment portfolio.

5 Frequently Asked Questions

What is FOMO?

FOMO stands for “Fear of missing out”, meaning the fear of missing out on positive experiences or opportunities that others are having.

Why is FOMO popular in investing?

Due to the development of social networks and technology, investors are easily influenced by rumors and information about high returns in some assets. They are afraid of missing out on opportunities so they rush to invest without thinking.

How can FOMO harm investors?

FOMO causes investors to make decisions based on emotions and lack of reason. They may buy at the top, sell at the bottom, or invest in risky assets without understanding. All this can easily lead to big losses.

How to control FOMO when investing?

It is necessary to build a long-term investment strategy, not letting FOMO change the plan. Only invest in knowledgeable assets and avoid believing in rumors. Always analyze carefully before making a buying decision.

Common mistakes due to FOMO?

Buying with the crowd when prices are rising, not daring to sell when prices rise for fear of missing out on the next opportunity, listening to rumors to invest in risky assets, not having a clear investment strategy.