The options market is increasingly attracting the attention of investors. To succeed in this world, you need to understand important terminology and concepts. In this article, we will introduce in-depth and expand on key terminology that every options trader should grasp to seize opportunities and effectively manage risks.

Table of contents

- Call option

- Put options

- Premium

- Strike Price

- Due date

- Profit, Loss and Breakeven (Moneyness)

- Out-of-the-money options

- In-the-money options

- Breakeven (At-the-money)

- Option Execution

- Option Settlement

- Cash payment

- Credit & Debit Spread Strategy

- Debit spread strategy

- Stock Options Contracts

- Indices

- ETF Options Contracts

- Ex-Vest Date

- Pin Risk

- Intrinsic and extrinsic values

- Time value

- Historical upheaval

- Implied volatility

- LEAPS

- Margin requirements

- Option adjustment

- Time wear and tear

Call option

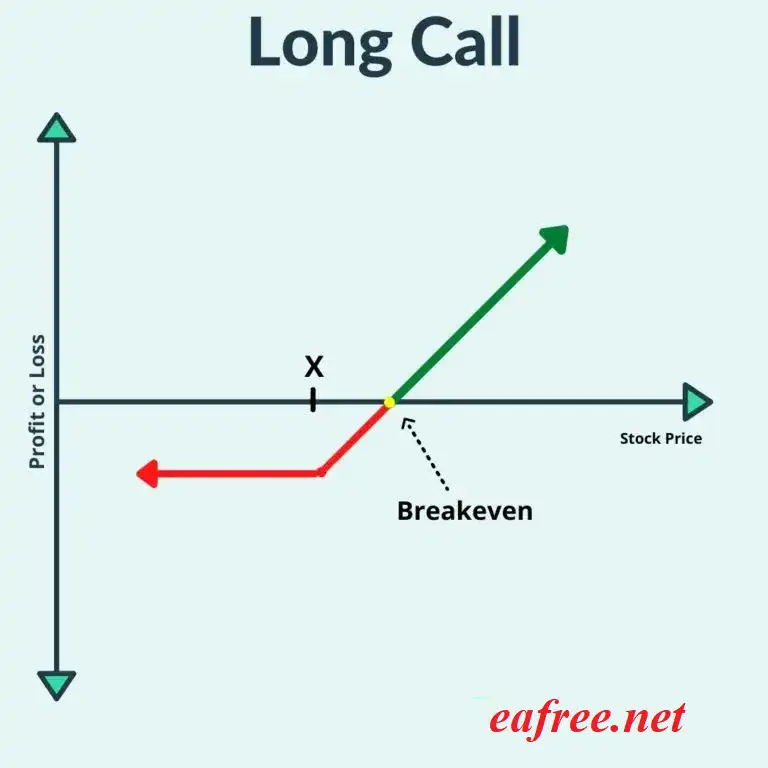

P/L chart of call options buying strategy

Call options allow holders of rights (not obligations) to purchase an underlying asset (usually stock) at a certain price (strike price) within a specific time frame.

Call option buyers will profit when the underlying asset increases in value. Since assets have virtually no price ceiling, call option sellers carry infinite risk.

Put options

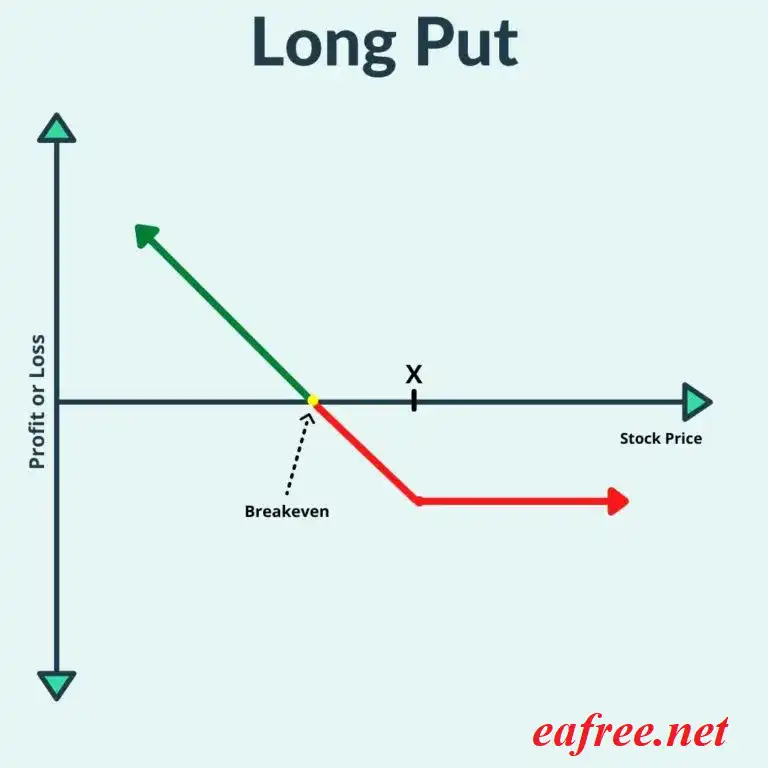

P/L chart of put options buying strategy

A put option is the opposite of a call option, which allows the right holder (not the obligation) to sell the underlying asset (usually shares) at a certain price (strike price) on a certain date (expiration date).

Put options increase in value when the underlying asset falls. Therefore, buying put options is usually hedging activity in the case of holding the underlying asset.

Premium

Like stocks, premiums represent the current market value of the option. Unlike stocks, however, premiums are listed per share. Since an option contract represents the right to buy 100 shares of the underlying index/share, the actual cost of a call or put option trading at $1 would be $100. Factors such as the strike price, intrinsic value, time value, and volatility all affect the determination of the premium.

Strike Price

The strike price is the fixed price at which the put/put option can be exercised. When executed, the seller will sell the underlying asset to the buyer at this strike price. The difference between the strike price and the current market value of the stock tells us whether this is an option of profit (in the money), loss (out of the money), or breakeven (at the money).

Due date

Unlike stocks, all options expire on a set date. By the expiration date, All options contracts maturing on this day are settled. The base price of the stock determines whether the option contract gains or losses. If the strike price of the option contract is profitable, it will be executed. If the option loses at maturity, it will expire worthless.

Profit, Loss and Breakeven (Moneyness)

The term “moneyness” is used to define the intrinsic value of an option at any given time. One option can be “in the money,” “out of the money,” or “at the money.” The relationship between the underlying share price and the option strike price will determine whether the option is profiting, losing or breakeven.

Out-of-the-money options

Call options lose if their strike price is higher than the stock’s current market price.

The option puts at a loss if its strike price is lower than the stock’s current market price.

In-the-money options

The option calls on interest if its strike price is lower than the stock’s current market price.

The option puts on profit if its strike price is higher than the stock’s current market price.

Breakeven (At-the-money)

Both call and put options are considered breakeven if the strike price is equal to the current market value of the stock.

Option Execution

Call/put option holders have the right to exercise their options contract at any time. When this happens, the option seller is obligated to buy or sell 100 shares at the strike price of the options contract.

There are many cases where option holders will want to exercise their right to buy shares, such as paying dividends (options that do not pay dividends). Options are usually exercised depending on the holder. However, all interest options at maturity will be automatically executed. If the option holder does not want to buy or sell the underlying share, they need to sell the option before maturity.

Option Settlement

Options contracts are settled in one of two ways: settled in the underlying asset or settled in cash.

Settlement in the underlying asset

The majority of options contracts are settled through physical delivery, i.e. when the option is exercised, the stock or underlying asset changes hands.

Cash payment

When options contracts are settled in cash, there will be no trading of the underlying asset. The cash transfer is quite simple and automatically will settle these types of options. Cash-settled options typically include European options, and most binary options.

Credit & Debit Spread Strategy

These are strategies that involve buying one option and selling another. Both are of the same type (call or put options), the same expiration time but different strike prices.

Credit spread strategy

Chart showing that the credit put spread will be profitable if the market price of XYZ closes above $68.50 at expiration.

In this strategy, we will simultaneously buy and sell the same option of the same asset but at different strike prices. Assuming the price of a stock is at $68.5, we sell 10 put options at $70 with a fee of 2, and buy another 10 put options at $65 for a fee of 0.5, so we have a net “credit” of 1.5. If the stock rises, we will make a maximum profit of $1,500 at $70 (the selling fee minus the buy fee) due to the put option short position, but if the stock falls, the loss will also be limited by the put option long position.

Debit spread strategy

In a debit spread strategy, we will simultaneously buy and sell the same option at different strike prices. But instead of having credit, we must have a debit, which is a lower fee for selling options than when buying.

Let’s say we buy a stock call option with a strike price of $100 and a $2 fee and sell a call option with a strike price of $105 and a $1 fee. Now we have a net debit of $1. The difference between the 2 strike prices is $5. The maximum profit that can be achieved is the spread of the execution price minus the net out ($4), which is achieved when the underlying share price reaches $105.

Stock Options Contracts

The stock options market represents the majority of tradable options. The underlying asset in this options market is stocks. If the option holder executes their contract, they will buy or sell 100 underlying shares at the strike price. Stock options are usually settled in the underlying asset.

Indices

Unlike stock options, one cannot buy the underlying assets of index options because they are not traded directly in the market. Market indices such as the S&P 500 will be the basis for the value of these types of contracts. Call and put index options give investors the right to buy or sell an entire stock index over a specified period of time at a specific strike price. Since no shares are traded directly, these options are settled in cash. This minimizes the risk that the seller does not have the base goods to hand over.

ETF Options Contracts

ETF options combine the characteristics of both index options and stock options. Like stock options, these options are settled in the underlying asset; Like index options, they represent a basket of stocks or a general market index. ETF options provide market participants with greater liquidity and diversification than single stocks.

Ex-Vest Date

The ex-dividend date is the date on which a company’s shares begin trading without the value of the issued dividend. To receive this dividend, an investor must own the stock before the market closes on the ex-dividend date.

To receive this dividend, profitable call option holders enforce delivery of their contract. The seller will be forced to sell the shares at the strike price. In order not to bear the obligation, the seller can exit the position.

Pin Risk

Pin risk in options trading occurs when the price of the underlying asset approaches the strike price of the option on the contract’s expiration date. If the contract is profitable at maturity, investors cannot exit the position. At this point, the call option will be exercised and the seller will hand over the shares. Therefore, investors should close all profitable long or short positions while the market remains open unless they wish to hold the stock.

Intrinsic and extrinsic values

The value of all options contracts can be calculated as the sum of their intrinsic and extrinsic value. Intrinsic value represents whether the option is worth anything if there is no time left. Therefore, at the time of expiration, the price of the put or call option must represent all intrinsic value.

The extrinsic value represents all remaining premiums, determined by the time remaining before maturity and market volatility. Therefore, call or put options that mature after 3 months will have a higher extrinsic value than options of the same type that will expire after 1 month.

Since option prices are derived from one or both of these values, knowing one value along with the current options market price will tell us the other. For example, if a call option is trading at $3 and has an intrinsic value of $2, the distance represents an extrinsic value of $1.

Time value

The extrinsic value of an option is determined by both its time value (theta) and volatility. This part of the time value refers to the amount of time remaining until the expiration of the call or put option.

Historical upheaval

In options trading, historical volatility is a metric that uses the past results of an underlying stock to calculate the option premium of a call and put option contract.

Implied volatility

Implied volatility is a forward-looking valuation measure used in options trading. This type of volatility takes into account the impact of future uncertainties, such as corporate earnings, on the price of call or put options. Supply and demand are the main components to determine implied volatility.

LEAPS

LEAPS are options with a maturity of more than 1 year. LEAPS options are like all other options of their kind, except for longer maturities. As a result, the LEAPS premium will also be higher initially, then gradually decrease as it approaches the expiration date. Investors sometimes use the LEAP put option as a long-term hedging policy on their stocks.

Margin requirements

Compared to stock trading, determining margin requirements with options is a complex process. The amount of cash/securities required in your account to execute certain options trades will depend on the broker you use.

This usually involves the option seller rather than the buyer, as the risk of losing money when the option loses is much greater than the amount of fees received. As for option buyers, they only lose the purchase fee at most. When you buy a call option for $3, you have the potential to make infinite profits, but only a maximum of $3.

Conversely, with sellers, they earn up to $3, but they can lose infinitely if the stock rises. The margin requirement will determine if the seller is allowed to sell this option.

Option adjustment

An option adjustment is a strategy for changing the strike price and/or expiration date. This can help align call/call options more reasonably with the actual price of the underlying asset. There are many reasons to adjust the option, such as avoiding having to pay too early or extending the trading time so that you do not have to enforce losses.

Time wear and tear

Time wear and tear (also known as “theta”) measures the rate at which an option loses value over time. Unlike stocks, all call and put options have expiration dates. As that day approaches, the premium on an option contract loses its value. After expiration, the option will lose its entire offset of time.

Understanding these key terms provides a solid foundation of knowledge to confidently participate in the options market and make informed investment decisions. Mastering these concepts will help you optimize your profit potential and risk management in this dynamic world of opportunities and challenges.