Margin accounts are an important concept in financial transactions, especially in the foreign exchange (Forex) market and the stock market. This is a powerful tool that allows traders to take advantage of financial leverage to increase profits, but it also comes with high risks. In this article, we will go into more detail about margin accounts, how to calculate margin, and how to use margin in financial transactions.

Table of contents

1. Margin Accounts: The Basics

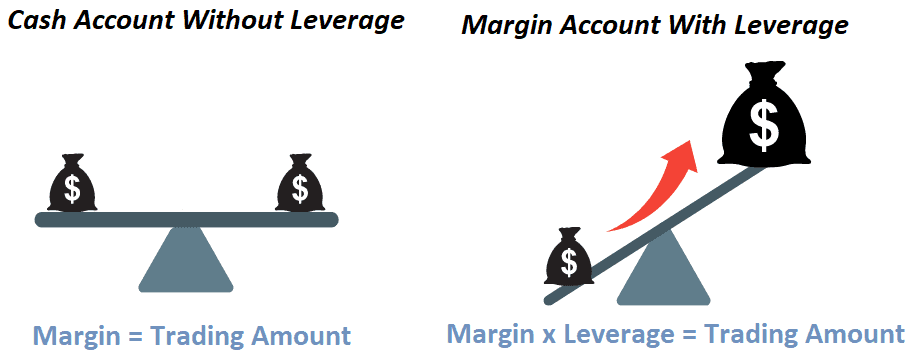

A margin account is a type of account that traders open at an exchange to engage in financial trading. This account allows traders to buy and sell financial assets such as currencies, stocks, or commodities with money borrowed from the exchange. The goal of using a margin account is to take advantage of financial leverage to increase profits in trading.

Margin accounts work by opening an account at an exchange, and then you fund that account. This amount will be used as collateral to execute trading orders. The amount of money you have available in your margin account after deducting the value of open and pending orders is called available margin.

1.1. How to Calculate Margin

To understand how to calculate margin, we need to know two important concepts: available margin and required margin.

Available Margin: This is the amount of money you have available in your margin account after calculating all open and pending orders. Available margin is usually calculated according to the formula:

Available Margin = Account Amount – open order – pending order

Available Margin is the amount of money you have available to execute new orders or maintain open orders.

Required Margin: This is the amount of money needed to maintain your open orders. The required margin depends on the size of the order and the financial leverage you use. The formula to calculate the required margin is:

Required Margin = position size/ leverage

Required Margin is the amount of money you need to ensure that you have enough funds to maintain your open positions.

2. Using Margin In Trading

Using margin in trading can create great opportunities to increase profits, but it also comes with high risks. Here are some ways you can use margin in financial trading:

Financial Leverage: Use financial leverage to open larger orders with a smaller amount of capital. This can create an opportunity to increase profits if the market moves in the direction you predict.

Large Order Sizes: With a margin account, you can open larger orders, which can lead to significant profits if the market moves in your desired direction.

Diversification: Margin allows you to invest in many different assets, creating diversification in your portfolio.

Save Capital: By using financial leverage, you can save your initial investment capital.

3. Risk and Risk Management

Although using margin can create great opportunities for profits, it also comes with high risks. Risk management is an important part of using margin in trading.

Double Profit and Loss: Using margin can increase profit and loss if the market moves against your prediction. It is very important to determine the level of risk you can accept before opening a position.

Marginal Signal Call: The trading platform reserves the right to call marginal signal if your account does not have enough funds to maintain open orders. This may lead to automatic order closure and loss of invested capital.

Diversification: Diversify your portfolio to reduce risk.

4. Benefits and Risks of Using Margin

Using margin can bring great benefits in financial trading, but it also comes with high risks. Here are some basic benefits and risks:

Benefit:

Increase Profits: Using margin can increase profits if the market moves in the direction you predict.

Diversification: Margin allows you to invest in many different assets, creating diversification in your portfolio.

Save Capital: By using financial leverage, you can save your initial investment capital.

Risk:

Losing Capital Quickly: Using margin can create the risk of losing capital quickly, especially if the market moves against your predictions.

Calling Marginal Signals: Calling marginal signals can lead to automatic order closure and loss of invested capital.

Difficult Risk Management: Risk management is an important part of avoiding large profits and losses.

5. Conclude

Margin accounts are a powerful tool in financial trading, but they also come with high risks. Understanding how to calculate margin, how to use financial leverage, and manage risk is important to becoming a successful trader. Always consider risks and follow your trading plan to ensure safety when trading using margin.