The Federal Reserve’s Balance Sheet is one of the most important documents in the US financial system. It provides extensive insight into central bank operations and their impact on the country’s economy and financial markets.

In this article, we will explore and explain the Fed’s Balance Sheet in detail and understand its implications for the financial system.

Table of contents

1. What is the Fed’s Balance Sheet?

The Fed’s Balance Sheet is a real-time statistical document that describes the assets and liabilities of the United States Federal Reserve, commonly known as the Fed. It is updated weekly and contains information about the Fed’s financial situation.

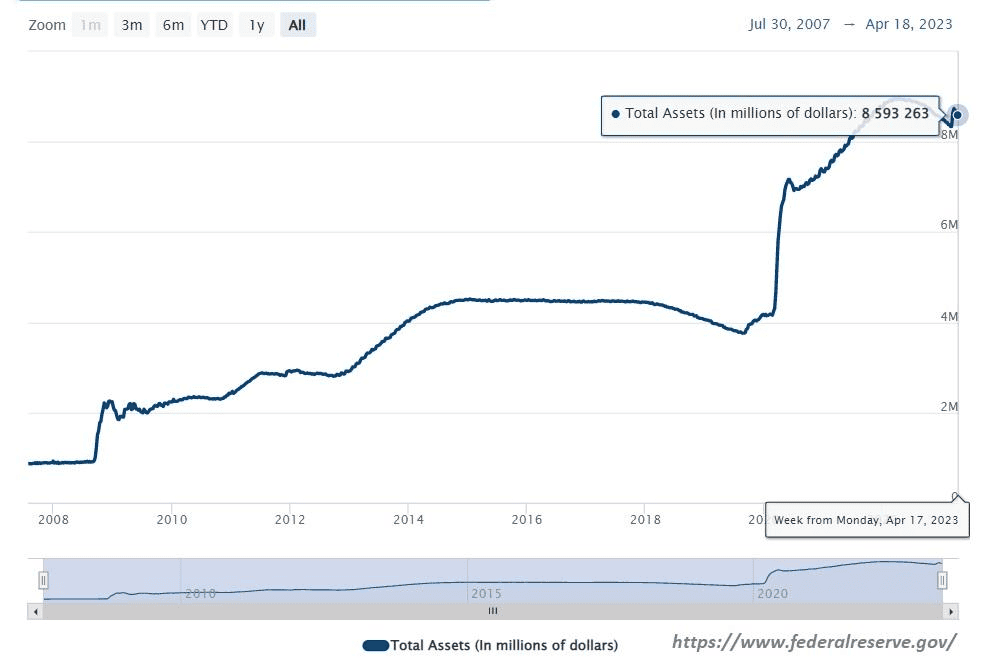

The FED’s total assets as of April 17, 2023 are 8,593,263 million USD.

2. Detailed Analysis of the FED’s Balance Sheet

2.1 Assets Section:

This section records the assets that the Fed holds. Here are some important assets that often appear in this section:

Cash and Monetary Instruments: This is the amount of money the Fed holds in the financial system and can use to influence the amount of money in the economy.

Government Bonds: The FED buys and holds government bonds to control interest rates and stabilize the bond market.

Corporate Bonds: The FED sometimes also buys corporate bonds to support financial markets and the economy.

2.2 Liabilities:

This section records the debts and commitments that the Fed must guarantee. Here are some important clauses in this section:

Commercial Bank Reserves: This is the amount of money commercial banks are required to keep at the Fed, and it affects the amount of money banks have available to lend.

Government Deposits: The Fed also manages government deposits, including taxes and government spending.

3. Meaning of the Fed’s Balance Sheet

3.1. Monetary Policy:

The Fed’s Balance Sheet provides insight into the Fed’s monetary operations. Through buying and selling government bonds and adjusting reserve reserves, the FED can control interest rates and the domestic currency situation.

3.2. Impact on Financial Markets:

Changes in the Fed’s Balance Sheet can affect financial markets. Buying and selling government bonds can change their value, affecting the bond and stock markets.

3.3. Investment Opportunities:

Investors monitor the Fed’s Balance Sheet to evaluate investment opportunities. A change in its structure could create investment opportunities or change their investment strategy.

3.4. Assessing the Economic Situation:

This table also provides information about the buying and selling of the Fed, which can evaluate the economic situation. When the Fed buys a lot of government bonds, it’s often related to supporting the economy during tough times.

4. Conclusion

The Fed’s Balance Sheet is an important tool in managing the United States’ currency, financial markets, and economy. It provides valuable information for money managers, investors and economists to evaluate situations and make decisions. Understanding the Fed’s Balance Sheet is an important part of monitoring and understanding a country’s financial and monetary system.