Forex trading is one of the popular forms of investment today, attracting the attention of many people. With a daily trading volume reaching trillions of dollars, the Forex market is where investors can earn high profits. However, to be successful in Forex trading, you need to have the necessary knowledge and skills. In this article, we will focus on how to trade Forex with two popular candlestick reversal patterns, Bullish and Bearish Engulfing.

Table of contents

- Introduction to Forex trading

- What is Bullish and Bearish Engulfing?

- How to recognize Bullish Engulfing in Forex trading

- How to recognize Bearish Engulfing in Forex trading

- Benefits of using Bullish and Bearish Engulfing in Forex trading

- Steps to trade Forex with Bullish and Bearish Engulfing

- Notes when using Bullish and Bearish Engulfing in Forex trading

- Forex trading strategies with Bullish and Bearish Engulfing

- Real-life example of Forex trading with Bullish and Bearish Engulfing

- Summary and tips when trading Forex with Bullish and Bearish Engulfing

- Conclude

Introduction to Forex trading

Forex, short for Foreign Exchange, is the world’s largest currency trading market. This is where traders buy and sell currency pairs against each other in order to profit from the price difference between currency pairs. This market operates 24/7 and has high liquidity, allowing investors to buy and sell currencies at any time.

There are many different ways to trade Forex, including technical analysis trading, fundamental analysis trading, and market sentiment trading. Among them, technical analysis is one of the most popular and widely used methods by investors in this market.

What is Bullish and Bearish Engulfing?

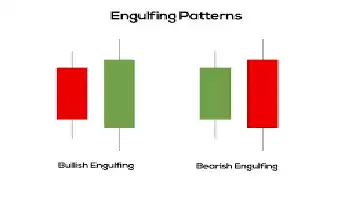

Bullish and Bearish Engulfing are two reversal candlestick patterns, which means they signal a reversal of the current trend. This means that when a downtrend is underway, Bullish Engulfing will signal a reversal from a downtrend to an uptrend, while Bearish Engulfing signals a reversal from an uptrend to a downtrend.

Each Engulfing candlestick pattern consists of two candles, with the second candle completely covering the first candle. Specifically:

- Bullish Engulfing: The second candle is a bullish candle, with a larger body than the first candle, which is a bearish candle.

- Bearish Engulfing: The second candle is a bearish candle, with a larger body than the first candle, which is a bullish candle.

How to recognize Bullish Engulfing in Forex trading

To recognize Bullish Engulfing in Forex trading, you need to note the following characteristics:

- Downtrend: Bullish Engulfing often appears at the bottom of a downtrend. This means that when the price is falling, Bullish Engulfing will signal a reversal and the new trend could be up.

- Large candle body: The second candle of the Bullish Engulfing pattern has a larger body than the first candle. This shows that the strength of buying pressure is increasing and is likely to push prices higher.

- Color: The second candle of Bullish Engulfing is blue or white, indicating market price growth.

How to recognize Bearish Engulfing in Forex trading

Similar to Bullish Engulfing, to recognize Bearish Engulfing in Forex trading, you also need to note the following characteristics:

- Uptrend: Bearish Engulfing often appears at the top of an uptrend. This means that when the price is rising, Bearish Engulfing will signal a reversal and the new trend could be downtrend.

- Large candle body: The second candle of the Bearish Engulfing pattern has a larger body than the first candle. This shows that the strength of selling pressure is increasing and is likely to push prices lower.

- Color: The second candle of Bearish Engulfing is red or black, indicating a bearish market price.

Benefits of using Bullish and Bearish Engulfing in Forex trading

Using Bullish and Bearish Engulfing in Forex trading can bring many benefits to investors, including:

- Identify entry points: When you recognize the Bullish or Bearish Engulfing pattern, you can identify entry points with a better risk/reward ratio.

- Determine the order point: This model also helps you determine the order point to profit when the price has reversed to a new trend.

- Reduce Risk: By using the Bullish and Bearish Engulfing patterns, you can minimize the risk by placing your stop loss in a safe location.

- Increase your trading winning rate: Thanks to the accuracy of this model, your trading winning rate can increase.

Steps to trade Forex with Bullish and Bearish Engulfing

To trade Forex with Bullish and Bearish Engulfing , you can follow these steps:

- Step 1: Identify the current market trend.

- Step 2: Wait for the Bullish or Bearish Engulfing pattern to appear.

- Step 3: Determine the entry point and set stop loss.

- Step 4: Track and manage your orders.

- Step 5: Close the order when the price reverses to the new trend or when the profit target is achieved.

Notes when using Bullish and Bearish Engulfing in Forex trading

- Do not use a single model to decide to enter a trade: Although Bullish and Bearish Engulfing are two popular reversal patterns, they should not be used alone to decide to enter a trade. Combine with other tools and indicators to evaluate the market more comprehensively.

- Always set a stop loss: In any trade, setting a stop loss is very important to minimize risks. So, set your stop loss at a safe level when trading with Bullish and Bearish Engulfing.

- Focus on highly liquid currency pairs: When trading with the Bullish and Bearish Engulfing patterns, focus on highly liquid currency pairs such as EUR/USD, GBP/USD or USD/JPY.

- Always follow risk management: To avoid large losses in trading, follow risk management and do not invest more than 2% of your capital in one position.

Forex trading strategies with Bullish and Bearish Engulfing

- Trend trading strategy: With this strategy, you will only trade when the Bullish or Bearish Engulfing pattern appears in the main market trend. This increases your chances of success because major trends often last for long periods of time.

- Counter-trend trading strategy: This is the opposite strategy to the above strategy, you will trade when the Bullish or Bearish Engulfing pattern appears in a trend opposite to the main trend. However, to apply this strategy, you need to have good technical analysis skills.

- Price structure trading strategy: With this strategy, you will wait for Bullish or Bearish Engulfing patterns to appear in important price structures such as support or resistance zones. This helps increase the accuracy of your orders.

Real-life example of Forex trading with Bullish and Bearish Engulfing

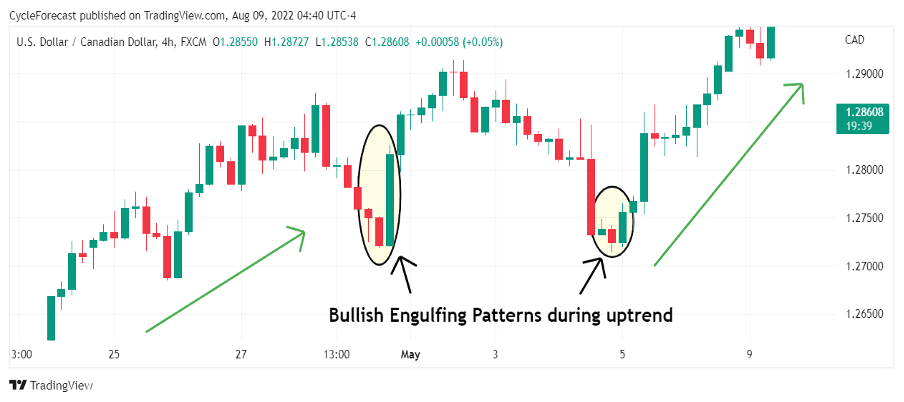

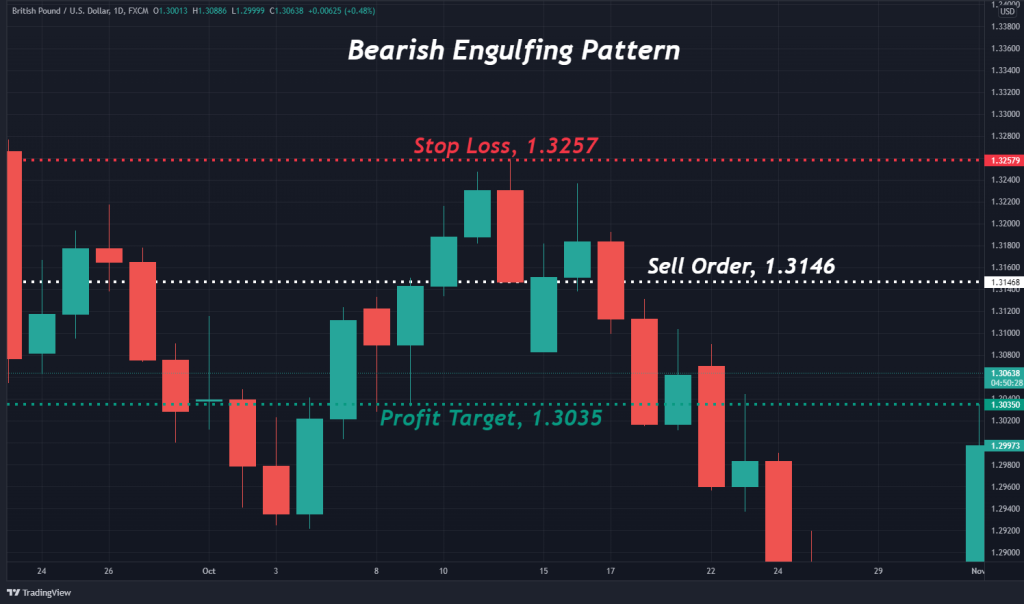

To illustrate Forex trading with Bullish and Bearish Engulfing , we will look at the following example:

At the chart USD/CAD H4 , we can see a Bullish Engulfing pattern appear after a price decline. This shows a market reversal and it is likely that the new trend will be uptrend.

On the GBP/USD D1 chart, we can see the Bearish Engulfing pattern appearing after a price increase. This shows a market reversal and it is likely that the new trend will be downtrend.

Summary and tips when trading Forex with Bullish and Bearish Engulfing

In this article, we learned about the two Bullish and Bearish Engulfing models in Forex trading. But to be successful in trading, you need to have good technical analysis skills and always follow risk management. Also, remember that no strategy is perfect and there is always risk in trading. Therefore, always consider carefully before deciding to enter an order and do not over-invest in a single order.

Conclude

Bullish and Bearish Engulfing are two popular reversal patterns in Forex trading. They can help you identify new market trends and increase your chances of trading success. However, to apply them effectively, you need to have good technical analysis skills and always adhere to risk management. Hopefully this article has helped you better understand Bullish and Bearish Engulfing and apply them to your trading. Wishing you successful trading!