Trading on the foreign exchange market (Forex) is one of the most popular and attractive forms of investment today. With high liquidity, quick profitability and flexibility in trading, Forex has attracted the attention of many investors around the world.

In Forex trading, using strategies is very important to make accurate and effective trading decisions. In this article, we will learn about the Forex trading strategy with Long Wick Candle , one of the widely used and highly effective strategies in Forex trading.

Table of contents

- Learn about Forex trading with Long Wick Candle

- Forex trading strategies using Long Wick Candle

- Advantages and disadvantages of using Long Wick Candle in Forex trading

- How to analyze Long Wick Candle charts to make trading decisions

- Factors affecting Long Wick Candle in the forex market

- Commonly appearing Long Wick Candle patterns and how to use them in Forex trading

- Forex trading techniques with Long Wick Candle

- Benefits of using Long Wick Candle in Forex trading

- Common mistakes when using Long Wick Candle and how to fix them

- Conclusion: Long Wick Candle’s effectiveness and applicability in Forex trading

Learn about Forex trading with Long Wick Candle

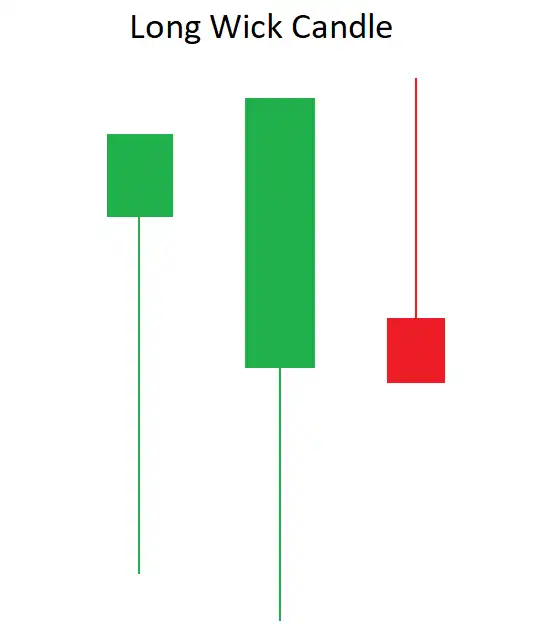

Long Wick Candle is a type of candle with a long shadow, often appearing in the context of strong price fluctuations. The long shadow of the candle can be located above or below the body of the candle, depending on which side is dominant during that period.

If the long shadow is above the candle body, this shows that the sellers tried to push the price down but were unsuccessful. The buyers counterattacked and pushed the price higher, causing the sellers to give up. This shows that the buyers are gaining strength and the price could continue its uptrend.

On the contrary, if the long shadow is below the candle body, this shows that the buyers tried to push the price up but were unsuccessful. The sellers counterattacked and pushed the price lower, causing the buyers to give up. This shows that the sellers are gaining strength and the price may continue to trend down.

With this property, Long Wick Candle can provide traders with potentially profitable entry points when participating in transactions in the Forex market.

Forex trading strategies using Long Wick Candle

In Forex trading, there are many strategies used to make trading decisions. And Long Wick Candle is also one of the useful tools used in these strategies.

Trend Trading Strategy

In this strategy, traders will look for trends in the market and place orders at highly profitable entry points. By using Long Wick Candle, traders can identify entry points when the price is in a period of strong fluctuations and is likely to continue the current trend.

To apply this strategy, traders need to analyze the Long Wick Candle chart and look for Long Wick Candle patterns that often appear in the current trend. Then, place orders at highly profitable entry points and place stop loss at the nearest support or resistance zones.

Short-term trading strategy (Scalping)

Scalping strategy is one of the popular strategies in Forex trading. With its fast and flexible nature, Scalping requires traders to be able to make quick decisions and use effective support tools.

In this strategy, Long Wick Candle can be used to identify short-term entry points. Traders can place orders at entry points when the price is in a period of strong fluctuations and is likely to continue an upward or downward trend.

News Trading Strategy

The News Trading strategy is one of the most popular and highly profitable strategies in Forex trading. With the highly volatile nature of the market when news is announced, using Long Wick Candle can help traders make accurate and effective trading decisions.

In this strategy, traders need to analyze the Long Wick Candle chart and look for Long Wick Candle patterns that often appear in the context of published news. Then, place orders at highly profitable entry points and place stop loss at the nearest support or resistance zones.

Advantages and disadvantages of using Long Wick Candle in Forex trading

Advantage

- Providing traders with highly profitable entry points when prices are in a period of strong fluctuations.

- Helps identify current market trends and make accurate trading decisions.

- Flexible and can be used in many different trading strategies.

Defect

- Not the only tool to make trading decisions, it needs to be combined with other tools to ensure accuracy.

- It can be confusing when multiple Long Wick Candle patterns appear in the same chart.

How to analyze Long Wick Candle charts to make trading decisions

To analyze the Long Wick Candle chart, traders need to pay attention to the following factors:

The length of the shadow is long

The length of the long shadow can indicate the level of market volatility. If the long shadow is very long, this shows that the price has fluctuated strongly and is likely to continue the current trend.

Position of long shadow

The location of the long shadow is also important in analyzing the Long Wick Candle chart. If the long shadow is above the candle body, this shows that the buyers are dominant and the price may continue to rise. On the contrary, if the long shadow is below the candle body, this shows that the sellers are dominant and the price may continue to decrease.

Color of candles

The color of the candle can also indicate the dominance of the buying or selling side. If the candle is green, this shows that the buyers are dominant and conversely, if the candle is red, this shows that the sellers are dominant.

Factors affecting Long Wick Candle in the forex market

There are many factors that can influence the Long Wick Candle in the forex market, including:

Market fluctuations

Market volatility is the most important factor affecting Long Wick Candle. When the market fluctuates strongly, the possibility of Long Wick Candle patterns appearing is also higher.

Economic news

Economic news can greatly impact market volatility and cause prices to move sharply. Therefore, following economic news can help traders make accurate trading decisions when using Long Wick Candle.

Market psychology

Market sentiment can also affect Long Wick Candle. When traders have the same opinion and make the same trading decisions, the possibility of Long Wick Candle patterns appearing is also higher.

Commonly appearing Long Wick Candle patterns and how to use them in Forex trading

There are many Long Wick Candle patterns that often appear in charts and are used in Forex trading. Here are some common patterns and how to use them:

Pin Bar (Pinocchio Bar)

Pin Bar is one of the most popular Long Wick Candle patterns and is widely used in Forex trading. This pattern has a long shadow at one end of the candle and a very small candle body or no candle body. Pin Bars can show price reversals and are used to make entry decisions.

Hammer and Hanging Man

Hammer and Hanging Man are two similar Long Wick Candle patterns, only differing in their appearance. Hammer appears at the bottom of a downtrend and Hanging Man appears at the top of an uptrend. Both of these patterns have long lower shadows and small or no real bodies. They can indicate price reversals and be used to make entry decisions.

Shooting Star and Inverted Hammer

Shooting Star and Inverted Hammer are also two similar Long Wick Candle patterns, only different in the location of appearance. The Shooting Star appears at the top of an uptrend and the Inverted Hammer appears at the bottom of a downtrend. Both of these patterns have long upper shadows and small or no real bodies. They can indicate price reversals and be used to make entry decisions.

Forex trading techniques with Long Wick Candle

There are many Forex trading techniques that can be used using the Long Wick Candle, including:

Breakout Trading

Breakout Trading technique uses Long Wick Candle patterns to identify entry points when price breaks through support or resistance levels. Traders can place orders at these breakout points and place stop losses at the nearest support or resistance areas.

Reversal Trading

The Reversal Trading technique uses Long Wick Candle patterns to identify entry points when the price reverses and continues a new trend. Traders can place orders at these reversal points and place stop losses at the nearest support or resistance areas.

Trend Following Trading

The Trend Following Trading technique uses Long Wick Candle patterns to identify entry points within the current market trend. Traders can place orders at entry points when the price retests support or resistance levels that have been broken and place stop losses at the nearest support or resistance areas.

Benefits of using Long Wick Candle in Forex trading

Using Long Wick Candle in Forex trading has many benefits, including:

- Helps identify highly profitable entry points when prices are in a period of strong fluctuations.

- It is flexible and can be used in many different trading strategies.

- Helps analyze current market trends and make accurate trading decisions.

- Can be applied to many different currency pairs and time frames.

Common mistakes when using Long Wick Candle and how to fix them

Some common mistakes when using Long Wick Candle and how to fix them include:

Mistake 1: Not combining with other tools

Using only Long Wick Candle to make trading decisions can lead to mistakes. Traders need to combine with other tools such as technical indicators, moving averages, or price models to ensure the accuracy of trading decisions.

Mistake 2: Not considering market context

Using Long Wick Candle without considering the market context can lead to mistakes. Traders need to analyze factors affecting Long Wick Candle such as market fluctuations, economic news or market psychology to make accurate trading decisions.

Mistake 3: Not having a capital management plan

Not having a capital management plan when using Long Wick Candle can lead to high risks in trading. Traders need to have a clear capital management plan and follow it to ensure capital preservation and risk control.

Conclusion: Long Wick Candle’s effectiveness and applicability in Forex trading

In summary, using Long Wick Candle in Forex trading is highly effective and can be applied in many different trading strategies. However, traders need to combine with other tools and consider the market context to ensure the accuracy of trading decisions. In addition, a clear capital management plan is needed to control risks and preserve capital. Mastering Long Wick Candle patterns and applying them to trading will help traders achieve success in the foreign exchange market.