When traders use the MT4 (MetaTrader 4) or MT5 (MetaTrader 5) trading platforms, they may face a number of different fees and charges.

Below are some common fees that users may encounter when using MT4 and MT5:

Table of contents

1. Transaction Fee (Spread):

- Most brokers charge fees through the difference between the buying price (Bid) and selling price (Ask) of a financial asset, called the “Spread.”

- Spreads are an important part of a broker’s profits and can vary depending on the time of trade and the currency pair or other asset.

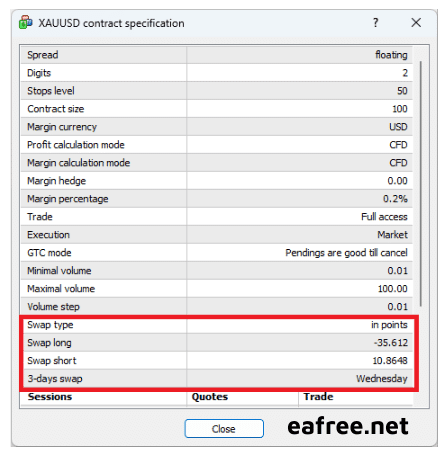

2. Swap Fee:

This is a fee that users may be charged for opening a position and leaving it open overnight.

- Swap Long (Positive Swap): If you buy a currency with a higher interest rate and sell a currency with a lower interest rate, you can get a swap long. This means you will be paid a certain amount (or currency) each night that you leave your long position open overnight.

- Swap Short (Negative Swap): If you buy a currency with a lower interest rate and sell a currency with a higher interest rate, you may have to pay a swap short. This means you will pay an amount (or currency) each night that you leave your short position open overnight.

These types of swaps are typically regulated by brokers and banks, and interest rates change over time and with financial market fluctuations. Before trading, you should check the swap policy of the specific broker you use to understand how swaps are calculated and applied in your trading.

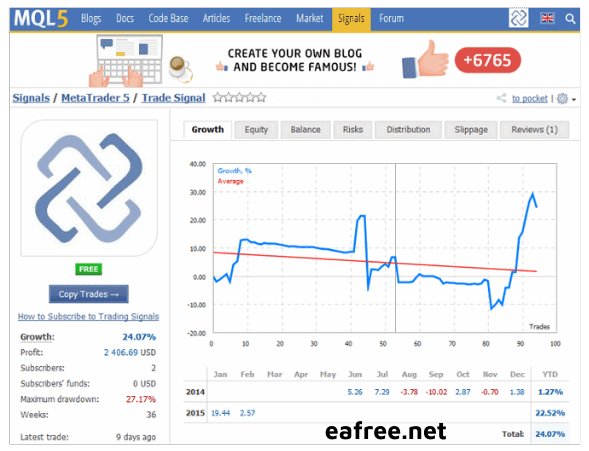

3. Commission:

- Some brokers, especially ECN (Electronic Communication Network) trading accounts, may charge a commission for each buy/sell order or a fee based on the number of lots traded or the value of the trade.

- This commission is often applied to ECN accounts to compensate for the benefit of direct market transmission.

- Applicable to specific accounts: Commission fees generally do not apply to all types of trading accounts. Instead, it typically applies to ECN or STP accounts, where brokers provide direct transmission to the markets and must charge fees to cover these costs.

- Calculated by lot or transaction value: Commission fees can be calculated by the number of lots you trade or based on the value of your transaction. For example, you may pay a fixed amount for each lot you buy/sell or a small percentage of the trade value.

- Depends on trading instrument: Commission fees may vary depending on the financial asset you trade. Popular instruments such as currency pairs in the forex market have lower commissions than trading stocks or cryptocurrencies.

- Fairness and Transparency: Brokers often publish their commission formula and display it in your trading account, helping you clearly understand your total trading costs.

When choosing a broker, you should consider both commissions and spreads to ensure that the total trading costs are reasonable and in line with your trading strategy.

4. Platform Fee:

- Some brokers may set platform usage fees or account maintenance fees.

- However, many brokers offer MT4 and MT5 for free to users.

5. Inactivity Fee:

Some brokers may impose fees if your account has no trading activity for a certain period of time.

6. Withdrawal Fee:

- Brokers may charge fees when you make withdrawals from your trading account. This fee usually depends on the withdrawal method you choose.

- These fees may vary depending on the specific broker and their trading conditions. Before opening an account and starting to trade, you should check your broker’s fee policy and understand all the fees you may face.